Top Stories

Nduka Obaigbena’s General Hydrocarbons Ltd Accuses First Bank Of Abusing Court Process, Warns Against Enforcing Asset Freeze Order

General Hydrocarbons Limited has urged all Nigerian commercial banks not to freeze its assets and accounts, following a December 30, 2024, order from Justice Deinde Dipeolu of the Federal High Court in Lagos State.

This development comes after First Bank of Nigeria Limited and FBNQUEST Trustees Limited accused General Hydrocarbons Limited of owing them approximately $225.8 million in outstanding debt from loan facilities granted as of September 30, 2024.

SaharaReporters reported earlier on Thursday that a Federal High Court in Lagos State had granted an ex-parte order, effectively freezing General Hydrocarbons Limited’s assets and accounts with all commercial banks in Nigeria.

This decision comes as a result of a lawsuit filed by First Bank of Nigeria Limited and FBNQUEST Trustees Limited, who claim that General Hydrocarbons Limited owes them a staggering US$225,802,379.69 in outstanding debt from loan facilities granted as of September 30, 2024.

The court order restricts all commercial banks from releasing or dealing with any assets or monies belonging to General Hydrocarbons Limited, its agents, subsidiaries, or sister companies, up to the amount claimed by the plaintiffs.

This move is likely intended to prevent General Hydrocarbons Limited from dissipating its assets or transferring funds out of the country while the lawsuit is pending.

However, General Hydrocarbons Limited has issued a warning to First Bank of Nigeria Limited (FBN) and its directors, stating that it will pursue severe legal action if its client suffers any losses or damages due to FBN’s actions.

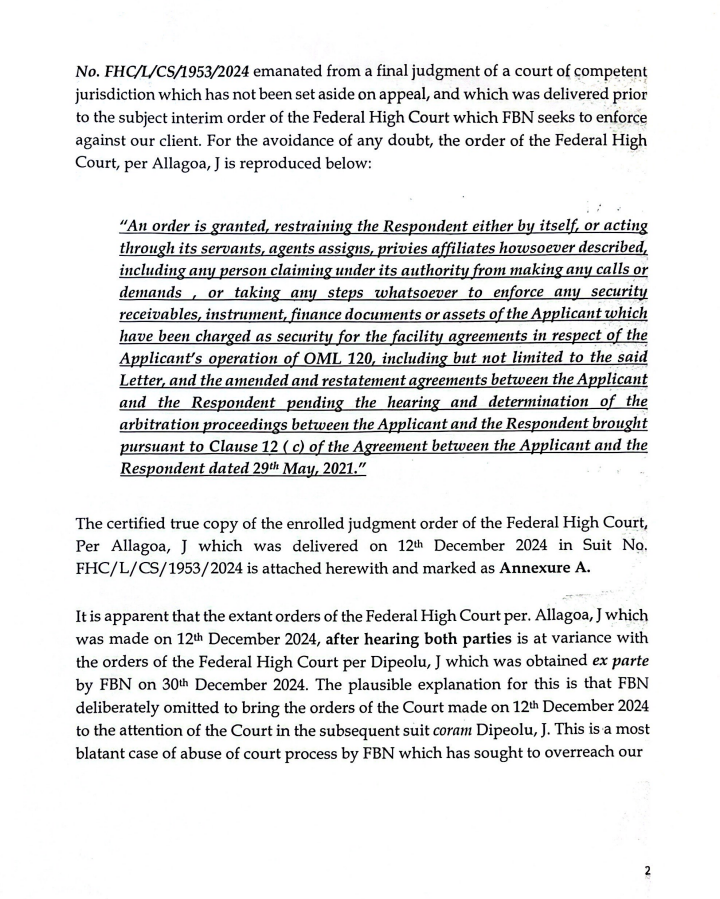

This warning was contained in a “Notice of Existence of Prior Order of Court” signed by Dr. A. I. Layonu SAN, counsel for General Hydrocarbons Limited, regarding Interim Mareva Orders in Suit No. FHC/L/CS/2378/2024.

Layonu revealed that measures have been taken to inform the Court about FBN’s alleged contempt and abuse of court process.

He advised affected parties not to enforce the Court orders obtained by FBN on December 30, 2024, against his client’s interests. This is pending resolution of the conflict between these orders and those of the Federal High Court in Suit No. FHC/L/CS/1953/2024, which explicitly prohibits FBN from seeking and obtaining the mareva orders issued on December 30, 2024.

“We also advise that you approach the Court coram Dipeolu, J to seek clarification on the propriety of the order of Court in view of the judgment order of Allagoa, J made on 12th December 2024,” the document read.

Counsel for General Hydrocarbons Limited issued a statement on January 9, 2025 titled, ‘To Whom It May Concern’, revealing that they only became aware of the interim mareva orders issued by the Federal High Court, presided over by Justice Dipeolu, on January 7, 2025. These orders, dated December 30, 2024, were made against their client.

It read, “The said orders of court effectively restrict our client’s access to its funds in your bank to the tune of $225,802,379.69 (two hundred and twenty-five million, eight hundred and two thousand, three hundred and seventy-nine United States dollars, sixty-nine cents), being the alleged outstanding indebtedness arising from the loan facilities/facility agreements between our client and First Bank of Nigeria Limited (“FBN”).

“Given this, we consider it imperative to notify you of the legal defects in the said orders as well as the grave legal implications of acceding to FBN’s attempt to enforce the said orders against our client’s interests in your bank.”

The counsel reminded that “the Federal High Court, per Allagoa, J had in a final judgment delivered on 12th December 2024 in Suit No. FHC/L/CS/1953/2024 – General Hydrocarbons Limited v. First Bank of Nigeria Limited, unequivocally and emphatically restrained FBN from taking any steps whatsoever to enforce any security, receivables, instrument, finance documents or assets of our client pending the hearing and determination of the ongoing arbitration proceeding between our client and FBN.

“We consider it imperative to draw your attention to the fact that the restraining order of the Federal High Court against FBN in Suit No. FHC/L/CS/1953/2024 emanated from a final judgment of a court of competent jurisdiction which has not been set aside on appeal, and which was delivered prior to the subject interim order of the Federal High Court which FBN seeks to enforce against our client. For the avoidance of any doubt, the order of the Federal High Court, per Allagoa, J is reproduced below:

“An order is granted, restraining the Respondent either by itself, or acting through its servants, agents assigns, privies affiliates howsoever described, including any person claiming under its authority from making any calls or demands, or taking any steps whatsoever to enforce any security receivables, instrument, finance documents or assets of the Applicant which have been charged as security for the facility agreements in respect of the Applicant’s operation of OML 120, including but not limited to the said Letter, and the amended and restatement agreements between the Applicant and the Respondent pending the hearing and determination of the arbitration proceedings between the Applicant and the Respondent brought pursuant to Clause 12 (c) of the Agreement between the Applicant and the Respondent dated 29th May, 2021.”

It added, “It is apparent that the extant orders of the Federal High Court per. Allagoa, J which was made on 12th December 2024, after hearing both parties is at variance with the orders of the Federal High Court per Dipeolu, J which was obtained ex parte by FBN on 30th December 2024.

“The plausible explanation for this is that FBN deliberately omitted to bring the orders of the Court made on 12th December 2024 to the attention of the Court in the subsequent suit coram Dipeolu, J.

“This is a most blatant case of abuse of court process by FBN which has sought to overreach our client by approaching another Judge of the same Court to obtain favourable orders that directly contravene an extant order of the Court which has not been set aside on appeal or otherwise.”

“Please be assured that we are already taking steps to bring FBN’s contemptuous act and abuse of court process to the attention of the Court and to seek stringent legal redress against FBN and its directors for any loss or damage that may be suffered by our client as a result of FBN’s actions,” it added.