News

Breaking: FOREX: Naira slides further, trades as low as N925/$

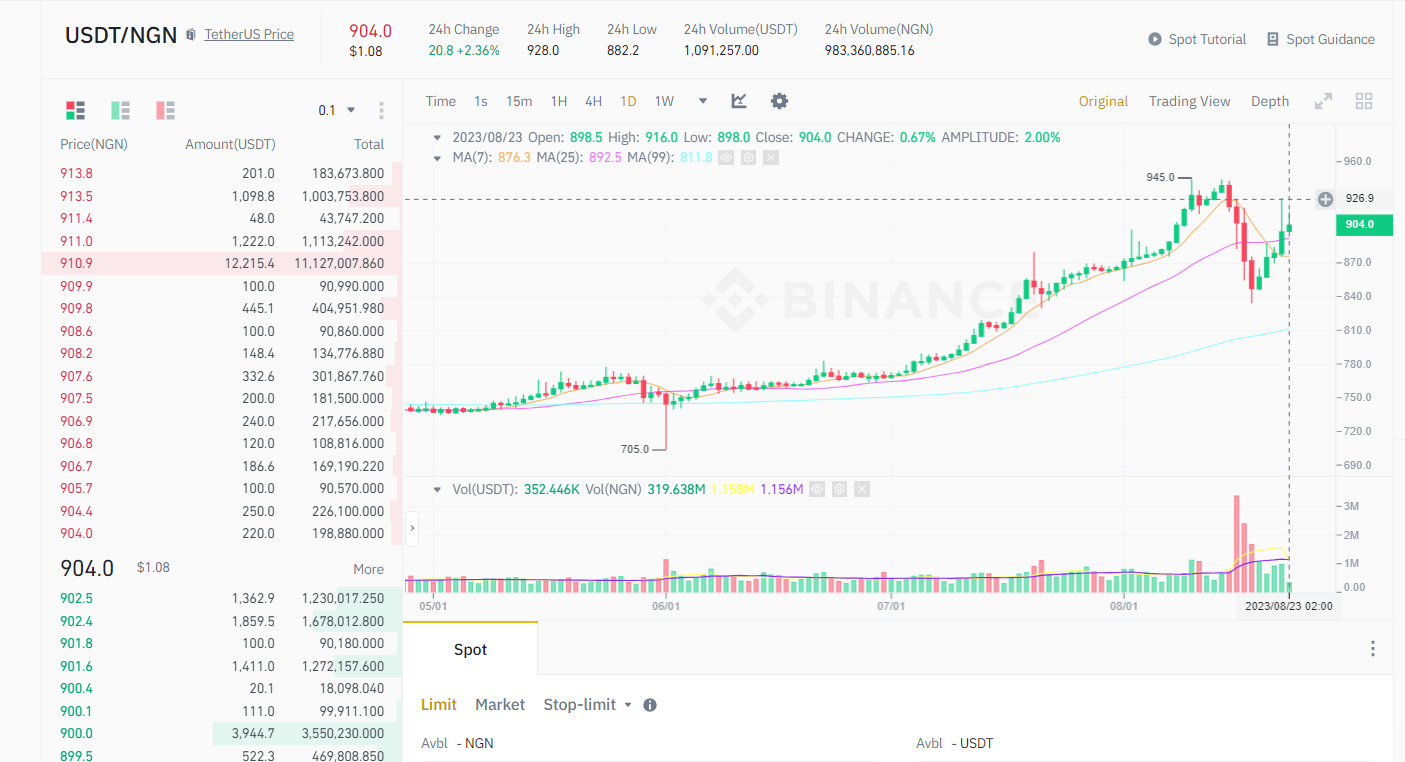

In the P2P market, the Naira fell as low as N925 against the dollar on Wednesday morning before moderating to the N905/$ levels at the time of drafting this report, following a JP Morgan report that put Nigeria’s net foreign exchange reserves at $3.7 billion.

P2P Market and Dollar-Backed Stablecoins

Nigerians access this dollar-backed stablecoins9(USDT) on the P2P market primarily for hedging and transactions.

The platform enables many young and tech-savvy people to convert their naira into these stablecoins denominated in dollars, making it simpler for them to send and receive money from abroad, buy goods and services, and process transactions more efficiently than Nigerian banks.

However, the market is largely unregulated and poses significant risks.

The Tier 1 American bank also stated that

- “Nigeria’s FX market will continue to be in focus given the true value of its net FX reserves, with an overall balance of payments deficit pointing towards continued FX pressure, which also noted that Nigeria’s FX reserves are” significantly lower than prior estimates, owing to larger-than-expected currency swaps and borrowing against existing reserves.

Short sellers are holding their ground against the naira even as the number of cash held outside banks dropped significantly from N2.26 trillion in June to N2.20 trillion in July.

FX Pressure and Regulatory Efforts

To stabilize the naira and curb inflation, the CBN has introduced several measures, including raising the banks’ cash reserve ratio (CRR), opening market operations (OMO), and changing the exchange rate regime.

While the market rallied on the news, it appeared to be short-lived support as the local currency subsequently fell against the dollar in the following segments.

The Nigerian National Petroleum Company (NNPC) Limited recently announced that it had secured an emergency loan of $3 billion from the African Export-Import Bank (Afreximbank) to stabilize the country’s foreign exchange market.

However, Currency speculation accelerated northward, despite the determination of the CBN to ensure market integrity of the country’s foreign exchange market, with the commencement date of the Price Verification System (PVS) Portal accompanied by Form M application.

Central Bank’s Initiatives and Economic Realities

The apex bank also announced the operational mechanism of the Bureau De Change Operations in Nigeria to boost participation and liquidity.

In addition, NGX proposes to allow the listing of dollar-denominated bonds and possibly expand into stocks to facilitate easy access to the currency for companies in Africa’s largest economy.

However, nothing seems to have changed from the real sector’s perspective as the prices of goods and services in Africa’s largest economy have exploded despite the apex ban’s effort to ensure price stability.

Economic Challenges and Skepticism

Fuel prices have more than tripled and inflation is the highest it has been in 18 years.

The Naira has been falling steadily since FG/CBN announced the Naira float. It lost nearly half its value against the US dollar within 10 weeks of its introduction.

The country’s apex bank reaffirmed its commitment to achieving price stability and exchange rate stability, but given the structural and budgetary difficulties the economy is experiencing, economists have expressed scepticism about the CBN’s capacity on its limited FX ammunition