Business & Economy

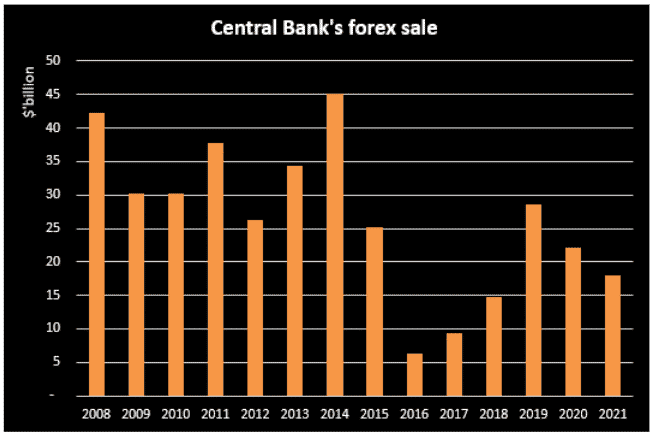

CBN Forex Intervention Falls To $18.03 Billion In 2021 As FX Liquidity Tightens

CBN Forex Intervention has fallen to $18.03 Billion in 2021 as FX Liquidity Tightens.

The Central Bank of Nigeria sold a sum of $18.03 billion in forex to various FX windows in 2021, representing an 18.6% decline when compared to the $22.16 billion sold in 2020 and a 36.9% drop as against the $36.9 billion recorded in 2019.

This is according to information gathered by Newsonline Nigeria from the apex bank. The decline is following stringent FX liquidity concerns, ravaging the Nigerian economy since the covid-19 pandemic struck in 2020. Also, the decline could be attributed to the halt in the sale of dollars to Bureau De Change operators in July 2021.

The Central Bank has been funding a huge chunk of Nigeria’s FX obligations, in a bid to maintain stability in the local currency. The currency has continued to depreciate at the black market, on the back of sustained increased demand for FX and dwindling forex inflow.

The disaggregated data from the CBN shows that a sum of $13.29 billion was sold at the Investors and Exporters window, SME, and Invisibles, representing about 73.7% of the total forex sales in the period under review.

Also, $2.77 billion was sold to BDC operators, between January and June 2021, before the CBN discontinued sales to them in July 2021. Meanwhile, $1.98 billion was sold at interbank, which only improved in mid-year, following the ban on FX sales to BDCs.

Tightening FX liquidity

Nigeria continues to suffer from the ripple effect of the covid-19 pandemic, which caused significant FX constraints in the economy, with capital inflows tanking to a then four years low of $9.66 billion in 2020, only to fall further to $6.7 billion in 2021.

In the same vein, the international trade balance remained in the negative region, triggered by a higher-than-normal surge in import duties and lower than desired export earnings. Notably, Nigeria’s foreign trade balance for 2021 plummeted to a deficit of N1.94 trillion, representing the highest foreign trade deficit on record.

Nigeria’s export increased by 51% to N18.91 trillion in 2021 from N12.52 trillion recorded in the previous year. However, the increase in export earnings could not compensate for the 64.1% uptick in import bills, which stood at N20.84 trillion.

Consequently, a contingent FX flight, triggered a $5.26 billion negative balance of payment in 2021, further piling more pressure on the local currency, hence the need to turn to the external reserve.

External loans to the rescue

The continuous intervention in the FX market by the CBN meant that Nigeria’s external reserve took a plunge, dropping to as low as $33 billion in June 2021, hovering around critical region before multiple external funding and recovery in the crude oil market elevated the reserve level.

Recall, that Nigeria raised a sum of $4 billion through the issuance of Eurobond in September 2021, in what was dubbed one of the biggest trade on the African continent in the year, with the order book of the issuance peaking at $12.2 billion.

Similarly, Nigeria also secured a $3.35 billion SDR allocation from the Internal Monetary Fund (IMF) in 2021, which was aimed at providing a boost to the Nigerian external reserve, a move which paid off, as the reserve level rose to $40 billion in October 2021. Meanwhile, the external reserves currently stands at $39.7 billion as of 13th April 2022.

As a result of the additional debt obtained by the federal government, Nigeria’s external debt profile rose to $38.39 billion as of December 2021 from $33.35 billion recorded at the end of 2020.

What happened at the FX market?

The Exchange rate between the naira and the US dollar dropped significantly by 6.03% in the year 2021 to close at N435/$1 as of the end of trading activities on Friday,31st December 2021, compared to N410.25 to a dollar recorded in the corresponding date of last year.

Meanwhile, at the parallel market, which is a more volatile market, naira crashed against the US dollar to close at N565/$1 on the 31st of December 2021 as against N460/$1, which was recorded at the end of the previous year.

The market differential between the official and the black market was N49.75 as of last year. It has now widened to N140.74, as surging demand for scarce forex puts exchange rate at record levels at the unofficial market.