Loans/Insurance

Mortgage rates: Homeowners rush to refinance during rate pause

Homeowners hurried to refinance their mortgages this week, capitalizing on a break from recent rate increases that added more than a half-point to the 30-year fixed rate in the last month.

It could be their last chance.

“The couple of weeks’ rise in mortgage rates can be a call to action for some potential borrowers. Headline news about rising mortgage rates and increasing expectations for the Fed to start tightening policy soon are a signal to get a deal in place,” Keith Gumbinger, vice president of HSH.com, told Yahoo Money. “Call it a preemptive strike of getting a refinance in place before mortgage rates run any higher.”

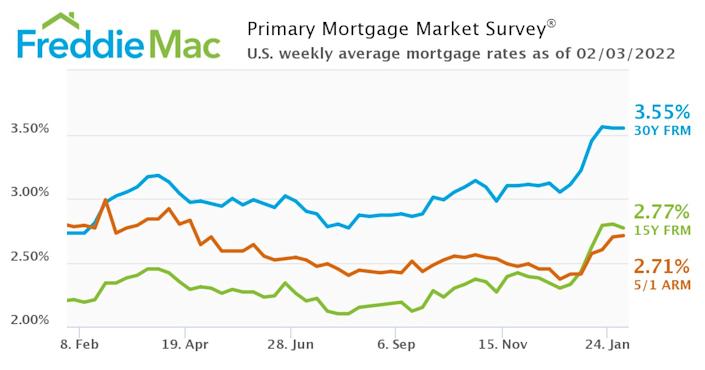

The rate on 30-year fixed mortgages (FRM) remained largely flat for the third week in a row, averaging 3.55%, according to Freddie Mac. The 15-year fixed-rate mortgage — often a go-to for refinancing — edged down to 2.77% this week from 2.80%.

Refinance applications were up 18% for the week ending January 28, according to the Mortgage Bankers Association (MBA), after rates began marching higher. The refinance share of mortgage activity increased to 57.3% of total applications from 55.8% the previous week.

“There has likely been some recent volatility in application counts due to holiday-impacted weeks, as well as from borrowers trying to secure a refinance before rates go even higher,” Joel Kan, the associate vice president of economic industry forecasting at MBA, said in a statement.

The population of high-quality refinance candidates who could shave three-quarters of a point from their mortgage rate dropped to 5.8 million in the third week of January when rates hit their highest point since the start of the pandemic, according to figures mortgage technology and data provider Black Knight previously gave Yahoo Money.

That population is likely to shrink even more after a surprisingly good January jobs report on Friday could mean that the Federal Reserve will pull back its support quicker, creating a higher interest-rate environment. The yield on the 10-year Treasury — which mortgage rates tend to track — jumped after the report.

Despite the recent rush, refi activity is still half its year-ago levels, according to the MBA, when rates clocked in at 2.73%, per Freddie Mac.

“While there was a jump in refinance activity per the MBA, it’s important to remember that this was a jump from a fairly low level of activity the week before,” said Gumbinger. “In the prior week, the MBA’s refinance index value was at its lowest value in about two years and the bump only returned refinance activity back to where it was in the first week of 2022.”

According to Freddie Mac, the higher mortgage rate forecast for this year and next will further slow refinance activity. Total refinances came in at $2.7 trillion in 2021, but are estimated to fall to $1.2 trillion in 2022 and $930 billion in 2023.

But cash-out refinances will likely stay active despite an increase in rates, according to Jeffrey Ruben, president of WSFS Mortgage, because people still need to fund larger expenses such as college tuition, a new car, medical bills, and home improvements.

They also have more equity to draw.

In the third quarter — the most recent data available — the number of homeowners who could pull out some equity while retaining at least 20% in their homes increased by 32% over the past year, according to Black Knight. Homeowners tapped that equity at the highest rate in more than 14 years, with cash-outs making up 54% of all refinances.

“When I suggest that the refinance market may contract as interest rates rise, it is primarily for those traditional refi folks,” Ruben said. “Although pulling cash out may not be as attractive as it was a few weeks ago, it’s still something that borrowers will access because of the need.”