Business & Economy

Fifteen months after its introduction, Naira4dollar promo fails to save Naira

Since the introduction of the Central bank of Nigeria’s (CBN) “Naira4Dollar Scheme” in March 2021, the Naira rate has fallen by a whopping N127 (or 26%)

Specifically, the parallel market rate of N612/$1 as of Monday, 4th of July, 2022, compares to N485/$1 prior to the launch of the “Naira4Dollar Scheme”.

- This reflects a N127 reduction or 26% depreciation to the value of the Naira on the parallel market since the scheme was implemented.

Naira4Dollar: The CBN launched the “Naira 4 Dollar Scheme” on March 8, 2021, to incentivize the inflow of remittances from the diaspora into the country, in response to the inadequate forex supply and ongoing pressure on the country’s exchange rate.

The key requirement for this Naira4Dollar program to function was that remittances from the diaspora had to be sent via an authorized international money transfer operator (IMTO).

- Thus, if you received a diaspora remittance of $20,000 (Twenty Thousand Dollars) CBN would simply credit your Naira account with an additional N100,000 (N5 x 20,000).

- Originally set to end in May 2021, this Naira4Dollar initiative was extended indefinitely.

Just in case anyone was interested in how this initiative was faring, the CBN released an update in February 2022, stating that diaspora remittances surged to $100 million weekly from $6 million (i.e. a 1,667% surge).

Why does this matter?

From the Central Bank of Nigeria’s perspective, the Naira4Dollar initiative has successfully provided an opportunity to encourage alternative FX inflows from non-oil sources.

However, from the perspective of an average Nigerian, it may be unclear how to acknowledge that this initiative has been successful. This is because the challenges of accessing foreign exchange persist.

Specifically, anecdotal data suggests that businesses continue to experience latency in getting backlogs of FX orders fulfilled. These anecdotal experiences can arguably be evidenced by notifications from key operators such as

- In February 2022, Nigerian Banks sent out a plethora of communication advising customers of reduced dollar limits on debit cards

- In May 2022, IATA published information suggesting that Nigeria was owing airline operators a backlog of over $450 million.

So why is the scheme failing?

When the Naira4Dollar scheme was introduced in March 2021 (i.e. fifteen months ago), the CBN had suggested that a huge portion of the diaspora remittances would be incentivized to use the Naira4Dollar initiative rather than going through non-official channels.

- In other words, the target was to centralize the diaspora remittances of over $20 billion annually. Thus, centralized FX inflows would in-turn, favourably impact the value of the Naira and slow down its depreciation.

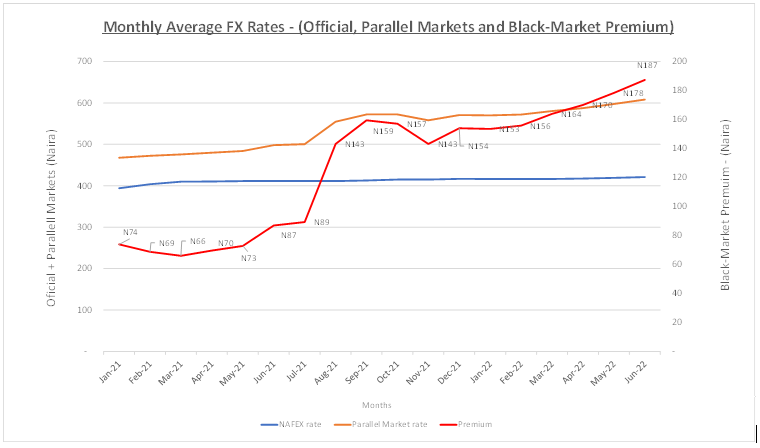

One can argue that in the early days of the Naira4Dollar initiative, some stability in the exchange rate was observed (see below chart).

- Specifically, between March-2021 and May 2021, the spread between the official exchange rate versus the parallel market rates oscillated in a narrow range below N75.

- However, since September 2021, the difference between the official rates and the parallel rates has simply exploded

- For 2022, the parallel market premium continues to rise

This widening spread between official and parallel market rates can potentially be attributed to several factors.

- However, a key theme of these factors is they all simply drive an incremental uptick in demand for the greenback compared to available fx supply.

From a demand uptick perspective a few notable changes occurred;

Firstly, observers of economic activity will recall that Nigeria eased a significant portion of its restrictions in the second quarter of 2021, as vaccines began to arrive in the country. Consequently, by the third quarter of 2021, demand for domestic and international travel had begun to rebound.

The impact of increased economic activity simply meant that by the third quarter of 2021, business demand for FX had simply bounced back, thus the relative stability in parallel market spread achieved by the Naira4Dollar scheme earlier in the year was simply not sustainable.

- Note that as Nairametrics had previously outlined, a significant driver of FX consumption is for service. This is in addition to business demand for FX to facilitate business imports

Secondly, in the first quarter of 2022, the Russia-Ukraine war commenced causing higher energy prices. This event and the consequent impact on energy and wheat prices added more pressure on our import bill.

- As Nairametrics has previously outlined, energy and wheat imports remain stubbornly in the list of top ten commodities imported

Consequently, it is not a surprise that as business demands for imports rebounded and FX demand got routed to the less bureaucratic parallel market, whatever incentive Naira4Dollar offered to diaspora remittance simply paled in comparison to the margins available in the black market.

Thus, as with basic economics principles, mismatches between demand and supply will always be reflected in price increases.

- In this case, the more demand gets routed away from the official window for whatever reason, backlogs, bureaucratic processes, price control etc, the more the FX rates in the parallel market will continue to widen to offset supply imbalance

So, does this mean that the Naira4Dollar initiative has failed completely?

The reality is that observers must acknowledge that the Naira4Dollar scheme is an attempt at establishing an FX marketplace in Nigeria, albeit under the supervision of a dominant participant the CBN.

- In fact, the CBN has doubled down on this approach to creating an FX marketplace that is has launched a similar scheme for the IEFX window to incentivize eligible corporates with N65/$1 remitted

However, at this stage, it doesn’t appear that the volumes being generated by this initiative are sufficient to match demand upticks.

Furthermore, inefficiencies such as business concerns about bureaucratic processes and price control may need to be addressed transparently.

One interesting thing to note is that the price control concerns at the IEFX window may have begun to abate in recent weeks.

- Specifically, the NAFEX rate closed at N425/$1 on Friday, 1st of July 2022 compared to the first-quarter average of N416/$1 (I.e. a 2% depreciation at the official window compared to the first quartet).

More actions by the CBN will be welcomed to further incentivize supply. Especially as the apex bank seeks to reduce the premium between its official rates and the parallel market.